- BUYING RESOURCES -

Mortgages & preapprovals

RESOURCES FOR:

Mortgages can be confusing and it may feel like there's endless amounts of options. Luckily, a lot of info and guidance on mortgages can be found online. It's also useful to reach out to mortgage companies, who can provide advice and a preapproval.

- PREAPPROVAL -

A mortgage preapproval is useful in showing you what homes you can afford.

On YELLOW, it's also important because it is required before you can visit or make an offer on any homes listed here. Sellers are able to set any preapproval threshold they desire.

For example, say a seller lists their home for $200,000. They can specify that they only want buyers preapproved for $180,000 or more to visit their home. We will not disclose what you are preapproved for, nor will we specify the minimum level set by the seller.

Having a preapproval helps both the buyer and seller because it prevents wasting time and resources on a home the buyer cannot afford. Plus, it helps keep sellers safe since they are letting strangers into their home.

- GETTING A PREAPPROVAL -

Contact lenders to get preapproved for a mortgage. It's easy and FREE!

THE PREAPPROVAL

Getting a preapproval is a fairly straightforward process where you submit some basic info on your financial situation. Usually within a day - and even just a few minutes with some online lenders - your lender will send you a letter stating how much you are qualified for. We'll have more on the process later.

Applying for the preapproval is not nearly as involved as applying for the actual mortgage.

YELLOW SAYS...

To get a preapproval, we recommend buyers first reach out to their current bank or credit union, especially if they are a larger bank.

It helps that you already have a relationship with them, and the loan consultants have a ton of information on loan types and can help determine the best loan for you.

You will want to shop around when applying for your actual mortgage after your offer is accepted, however.

Some professionals recommend shopping around and getting preapproval quotes from at least three different lenders. However, we think your bank is usually adequate for a preapproval.

LENDER TYPES

FINANCIAL INSTITUTION (BANK, CREDIT UNION, ETC.)

Most major and local banks offer mortgage products, and it's always a good idea to check with your current bank or credit union when looking for a lender. They may offer their current customers preferred rates or discounts.

NON-BANK LENDER

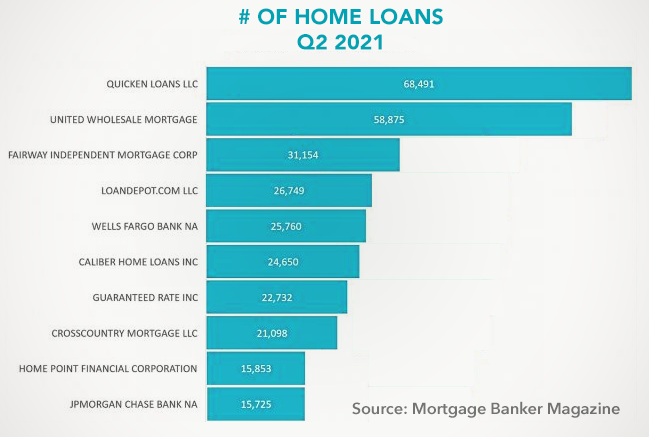

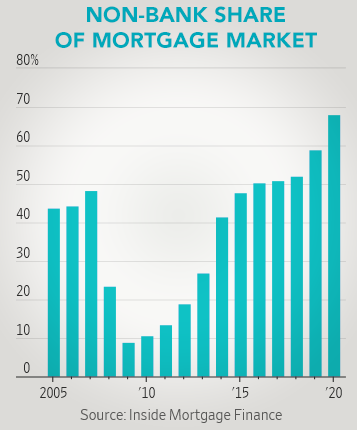

Nonbank lenders like Quicken Loans and Loan Depot are becoming increasingly popular. However, they may not provide as much assistance and customer support. They may not be the best choice if you are looking for assistance, but may be a good option for a knowledgeable, experienced buyer.

MORTGAGE BROKER

Mortgage brokers don't work for any specific mortgage company. What they do is search multiple lenders to find the best product for you. They are very knowledgable about loan types and can be of as much assistance as the financial institutions. They are usually local, independent companies and will charge a fee that is often rolled into the mortgage.

ONLINE MORTGAGE BROKER

These are like the mortgage broker listed above where they search for the right lender for you, but they are done online. These are the companies like LendingTree.com and Bankrate.com.

ADDITIONAL RESOURCES

- PREAPPROVAL PROCESS -

The process for a preapproval is fairly straightforward.

You will submit some basic info about your financial situation and provide supporting documents – but it won’t be nearly as thorough as your actual mortgage application you will apply for once you have found a home.

DOCUMENTS NEEDED FOR PREAPPROVAL

The lender will review this information and pull your credit before granting your preapproval. This process usually takes one day (or even the same day) with large lenders, but can take up to two or three days.

CAUTION!

Getting a preapproval may be comforting, but it doesn’t always mean you will eventually be approved for that mortgage.

Once your offer on a home is accepted, you will officially apply for the mortgage.

A mortgage underwriter will have to finalize the mortgage application, which means they need to verify your information, request and review more financial documents, and verify that the property meets certain requirements. This process on average takes about 45 days or longer! It's not uncommon for someone who was preapproved for a mortgage to ultimately be rejected.

COMMON CAUSES OF MORTGAGE REJECTION

Here's an article where the author had their mortgage rejected after having a preapproval:

Home Buying Institute A mortgage rejection tale

ADDITIONAL RESOURCES

- MORTGAGE RESOURCES -

An entire page could be written just on mortgages, but since there’s so much information already on the internet, we thought it would be more useful to share links that might be helpful.

MORTGAGE BASICS

MORTGAGE TYPES

FIRST TIME HOME BUYERS

YELLOW SAYS...

FINANCIAL PROGRAMS FOR FIRST TIME HOMEBUYERS

First time homebuyers (defined as someone who hasn’t owned a home in two years) have many helpful options available to them. Learn more from the links below.

FHA

VA

QUALIFYING FOR A MORTGAGE